UPI Charges: UPI Transactions in India to Incur Fees from April 1, 2023

Fees for UPI Transactions in India are Being Implemented:

The National Payments Corporation of India (NPCI) has declared that customers will have to pay fees for UPI transactions from April 1, 2023. This represents a substantial shift from the past, when UPI transactions were absolutely free.

Fees were implemented in response to the increasing popularity of UPI transactions. The growing amount of transactions has put a strain on the system's infrastructure, thus the NPCI has decided to collect fees to pay the costs of maintaining and upgrading the system.

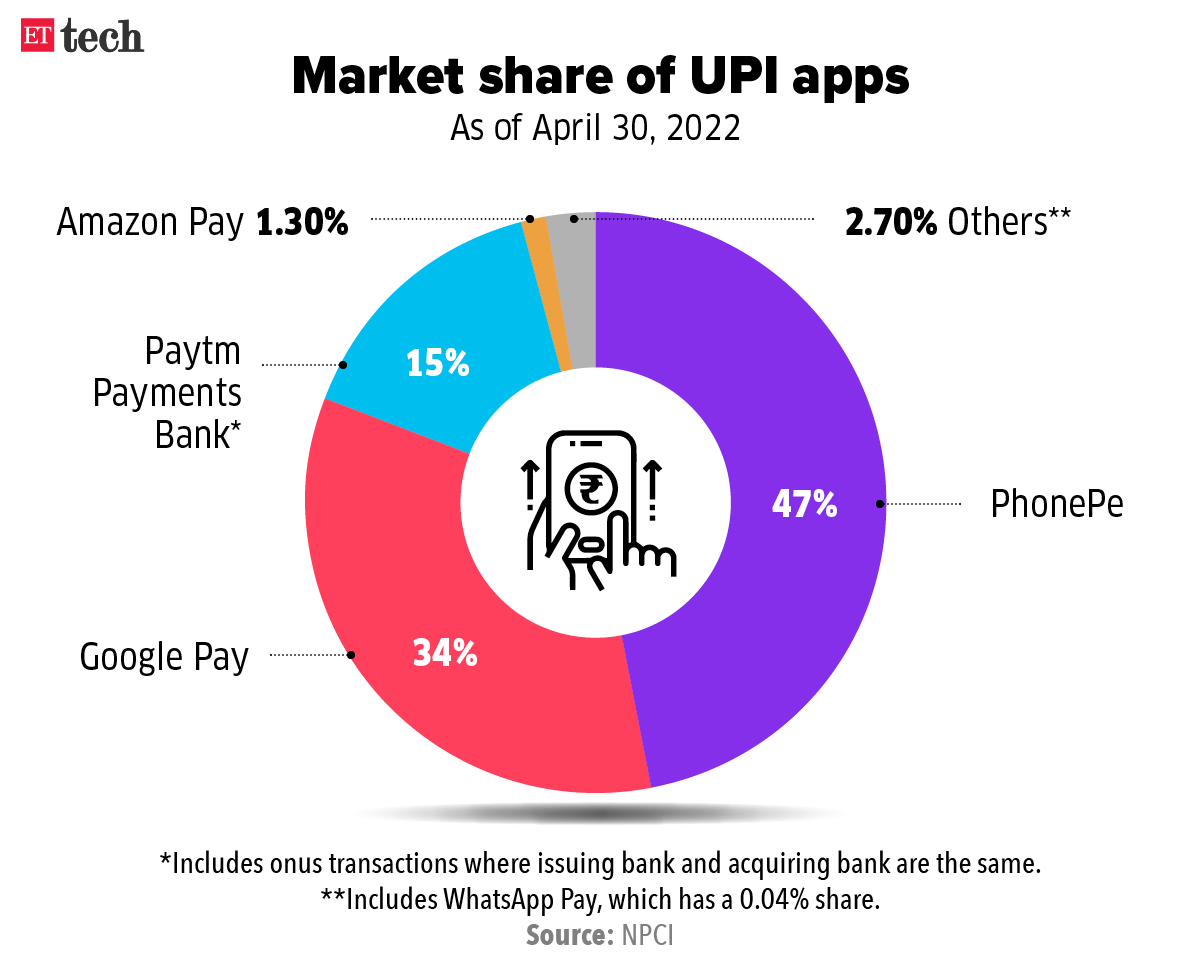

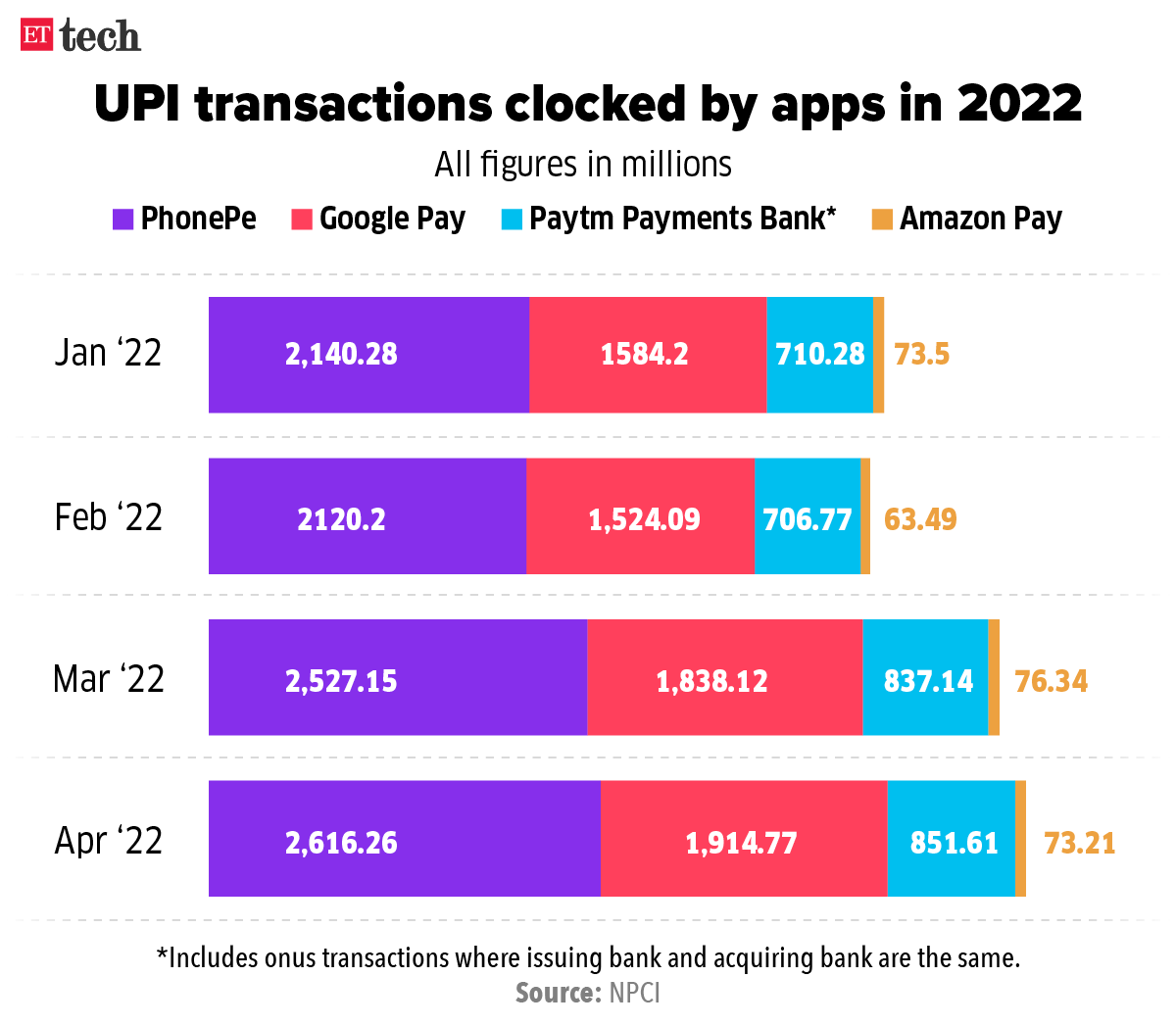

Users will have to pay fees for bank account to account money transfers beginning April 1, but there will be no fees for sending money to businesses or conducting transactions through UPI-based apps like BHIM, PhonePe, Google Pay, and Paytm. Fees will be paid based on the value of the transaction, with a maximum limit of Rs. 5 per transaction.

While customers have had different reactions to this revelation, it is crucial to remember that the NPCI has promised that the fees are minimal and will not have a substantial impact on the end user. Furthermore, the funds earned by these fees will be used to improve and streamline the UPI system, ultimately benefiting users.

It is also worth noting that the UPI system has already provided substantial benefits to Indian customers. UPI transactions have made money transfers easier and more convenient, allowing many small firms and people to engage in the digital economy. Fees for UPI transactions should not detract from these benefits, but rather contribute to ensure that the system is long-term viable and effective.

As a user, you should be aware of these changes and understand the costs that will be paid for UPI transactions beginning April 1. By staying educated, users may make informed decisions about how to use UPI and reap the many benefits that the system continues to provide.

Despite the introduction of fees for UPI transactions, the UPI system remains a highly convenient and cost-effective means to transfer money in India. UPI transactions are still faster, safer, and more trustworthy than traditional banking methods, and they provide numerous advantages to users.

UPI transactions, for example, can be completed 24 hours a day, seven days a week, regardless of bank holidays or weekends. This allows customers to transfer money whenever they need to, rather than needing to wait for a bank to open. Furthermore, UPI transactions are extremely secure, with numerous layers of encryption and verification in place to safeguard consumers' financial information.

Furthermore, UPI transactions provide a great level of flexibility, allowing users to transfer money from one bank account to another with only a mobile number or a UPI ID. This allows users to send money to friends and family, pay bills, and make purchases online or in-store more easily.

As the UPI system evolves and grows, we should expect to see more adjustments and improvements in the coming years. The NPCI, for example, has already announced plans to add new services like as UPI AutoPay and UPI QR code payments, which would make it even easier for users to conduct UPI transactions.

Finally, the installation of fees for UPI transactions in India beginning April 1, 2023, represents a substantial change in the payment system's functioning. While some customers may be concerned about this shift, it is critical to note that the fees are required to support the UPI system's infrastructure and ensure its long-term stability.

Nevertheless, the NPCI has stated that the costs will be small and will have little influence on end users. Instead, the fees raised will be used to improve and streamline the UPI system, ultimately benefiting users.

Despite the introduction of fees, UPI transactions in India continue to be a highly convenient and cost-effective method of money transmission. The system is secure, versatile, and offers various benefits to users, such as the ability to transfer money 24 hours a day, seven days a week, and complete transactions with just a mobile phone or UPI ID.

As the UPI system evolves and grows, we can anticipate more enhancements and innovations that will improve the user experience. Therefore, the introduction of fees for UPI transactions in India should not discourage users from using this payment system, but rather should highlight the benefits that UPI provides and encourage wider usage.

No comments